Financial operations are essential to your ISP’s success. However, many Internet Service Providers struggle with financial operations, especially when managing complex financial data. To improve financial operations and accounting processes, here are some key ingredients that can help to reduce costs and increase efficiencies.

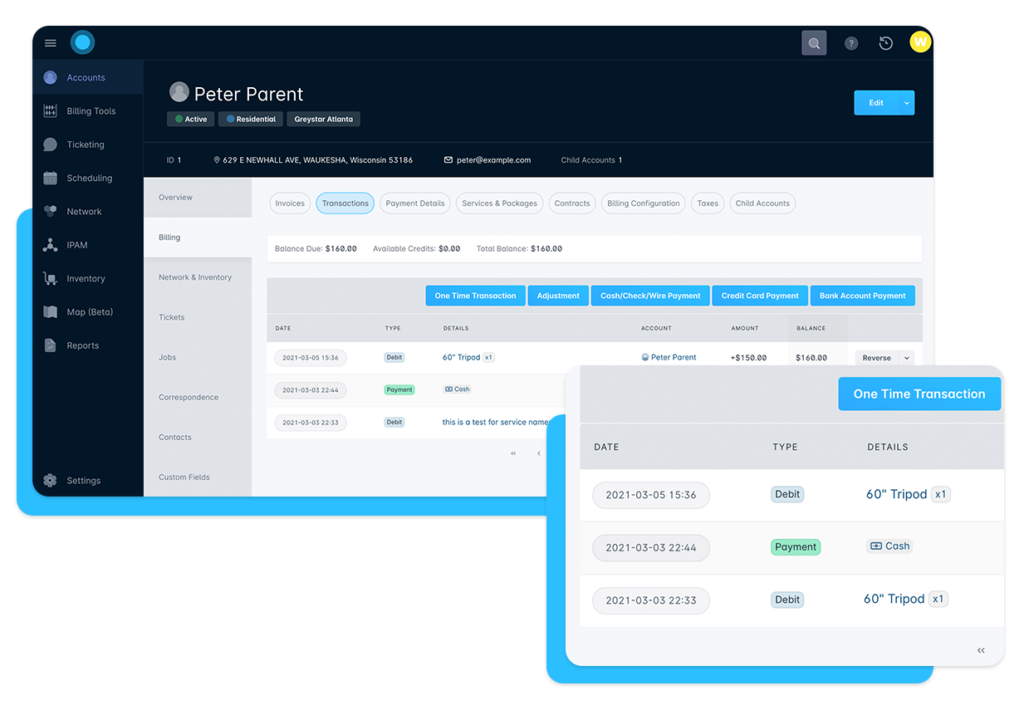

Automate Revenue Collection

Automated billing tools can be an effective way to improve the accounting process for ISPs of all sizes. By automating the billing process, businesses can save time, reduce errors, and improve customer satisfaction.

Automated billing tools can streamline the invoicing process by generating invoices automatically, sending reminders for unpaid invoices, and providing various payment options for customers. By automating this process, Internet Service Providers can save time and reduce errors, which can help to improve cash flow and financial management.

Another advantage of automated billing is that it can also be used to reconcile invoices automatically, which can help reduce errors and ensure that invoices are accurate and up-to-date. By automating this process, ISPs can save time and ensure that financial data is reconciled accurately and on time, which can help to prevent costly errors.

Finally, automated billing tools can help to improve customer satisfaction. By providing a user-friendly customer portal, various payment options, and automatic reminders, Internet Service Providers can make it easier for customers to pay their invoices on time. Automation can improve cash flow and reduce the need for manual follow-up with customers, which can save time and improve overall efficiency.

Automated billing tools can be an effective way to improve the accounting process. By streamlining the invoicing process, reconciling invoices automatically, and improving customer satisfaction, ISPs can save time, reduce errors, and improve financial management.

Tax Automation & Remittance

Tax automation software can ease the burden of tax compliance and filing. With tax automation software, accountants can automatically calculate tax obligations, prepare and file tax returns, and ensure all filings comply with current tax regulations. Tax automation software will eliminate the need for manual calculations and reduce the likelihood of errors, which can be time-consuming and costly to correct.

Another benefit of tax automation software is that it can save time and increase efficiency. Accountants can easily access tax records and other financial data, allowing them to quickly compile reports and identify areas where tax liabilities can be reduced. Tax software can also help accountants to stay up-to-date with tax regulations and changes, which can be a significant time investment if done manually. By automating tax calculations and filings, accountants can focus on more strategic activities such as financial analysis, forecasting, and planning.

With tax automation software, businesses can optimize their tax strategy and ensure that they are paying the correct amount of tax without incurring unnecessary costs.

Overall, tax automation software is a valuable tool for improving the accounting process and optimizing tax strategy to ensure that they are paying the correct amount of tax without incurring unnecessary costs.

Business Intelligence Reporting

Business intelligence reporting is a process of gathering, analyzing, and visualizing data to help businesses make informed decisions. When applied to accounting, business intelligence reporting can help improve the accounting process in several ways.

Business intelligence reporting can provide real-time financial data, including monitoring cash flow, analyzing revenue and expenses, and identifying potential financial issues before they become problematic. Access to accurate and up-to-date financial data allows businesses to make better decisions and improve the overall accounting process.

Business intelligence reporting can also help identify trends and patterns in financial data, which can be particularly useful in identifying areas where the accounting process can be improved. For example, if there are inconsistencies in how the financial data is being recorded, business intelligence reporting can help identify those inconsistencies and provide insights into how to address them.

Business intelligence reporting can help streamline the accounting process by automating specific tasks. For example, you can automatically generate financial reports, analyze financial data, and perform other functions that would otherwise require manual effort, which can help reduce errors and improve the accuracy of financial data.

Business intelligence reporting can be a powerful tool for improving the accounting process. By providing real-time financial data, identifying trends and patterns, and automating certain tasks, businesses can make more informed decisions, streamline their accounting processes, and ultimately achieve long-term success.

By implementing these strategies, you can improve financial operations and accounting processes to unlock internal efficiencies and better use staff time.