Seizing the Moment: BEAD Funding, Regulatory Shifts, and the Future of Rural Broadband

The broadband landscape is in flux, creating both hurdles and a wide range of opportunities for internet service providers (ISPs). Rural...

2 min read

Madeline Hanna

:

Sep 11, 2025

Madeline Hanna

:

Sep 11, 2025

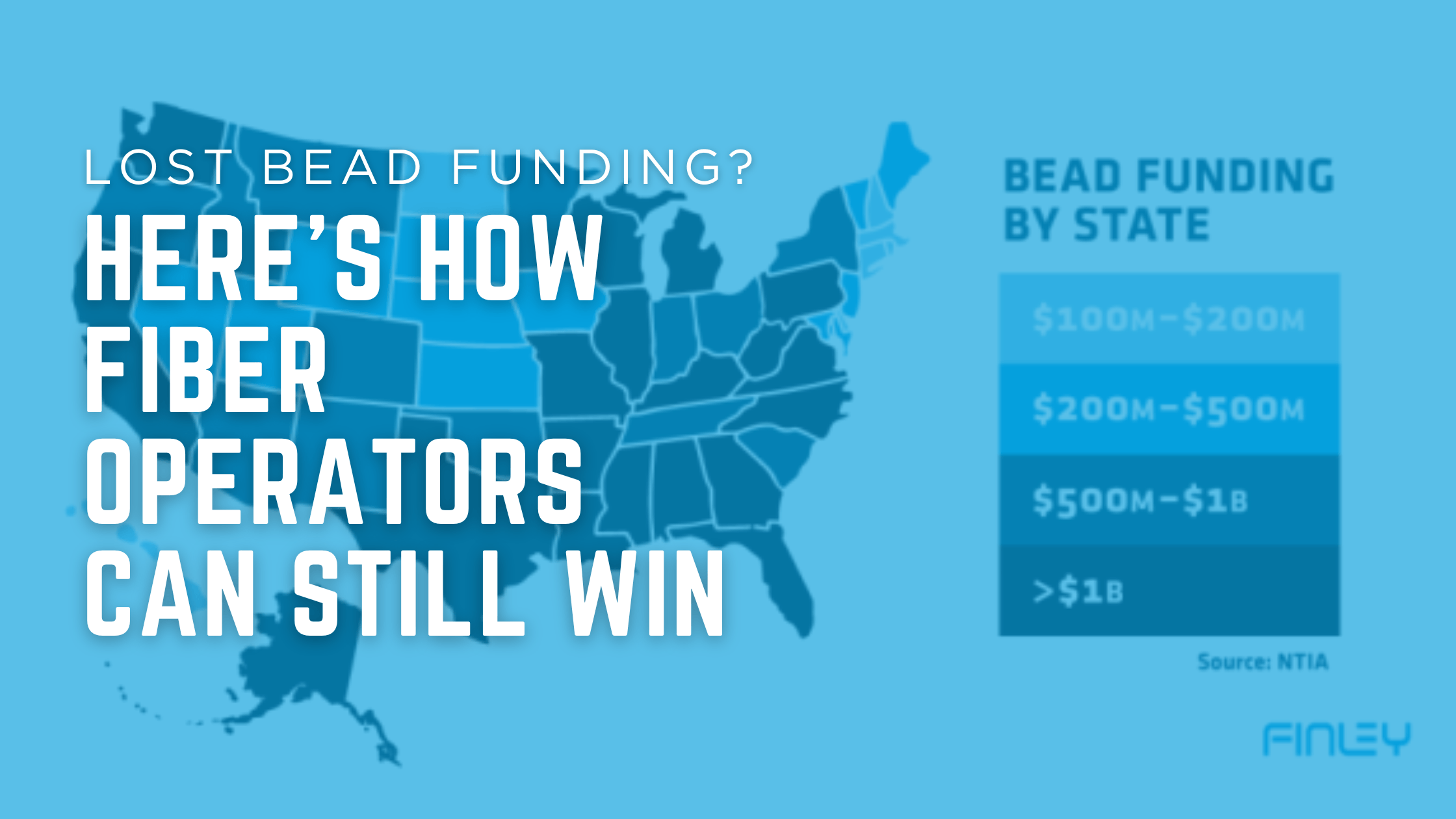

When BEAD was first announced, many fiber operators saw it as the golden ticket for rural broadband builds. But with recent changes—technology-neutral rules, stricter scoring, and fewer eligible areas—some fiber-first ISPs have been left behind.

If you didn’t qualify for BEAD funding, it’s not game over. With the right blend of alternative funding and a scalable operational stack, your expansion plans are still very much alive.

There’s no shortage of capital for fiber projects—just different doors to knock on. Some programs move faster. Others cover more ground or support long-term scalability.

As shown below, private investment far exceeds public funding in total dollars. However, state USFs and local partnerships often approve projects faster than multi-year federal cycles. Knowing where each path fits is your first strategic advantage.

USDA ReConnect Program

One of the most dependable federal programs, USDA ReConnect offers grants, loans, and hybrid funding. So far, it’s delivered $1.5B across 39 states—covering construction, electronics, labor, and more.

What to know:

Over 40 states operate USFs, distributing roughly $1.7B annually. Unlike BEAD, these programs often fund projects within 3–6 months.

Why this matters:

Find available programs through your State Public Utility Commission directory.

Local governments are bringing real dollars to the table. In 2022, over $10B in ARPA funding went to broadband projects via counties and municipalities.

For ISPs, this means:

Explore ARPA broadband funding guidance to connect with decision-makers in your area.

BEAD isn’t the only federal game:

Across all programs, success depends on the same formula: precise mapping, verified demand, and audit-proof compliance.

Not every build needs public money. Private broadband investment exceeds $90B/year and often closes in weeks—not months.

What investors look for:

Tap into regional banks, infrastructure funds, and broadband investors via associations like the Fiber Broadband Association.

Winning a grant or securing private capital is just the first step. Delivering on those dollars requires a high-performing operational backbone—and that’s where Sonar Software leads.

Sonar offers a flexible, fiber-ready platform to help ISPs streamline delivery—whether funded by BEAD alternatives or private capital.

Missed out on BEAD? Your broadband build is far from dead. Alternatives like ReConnect, state USFs, local partnerships, and private capital offer viable paths to funding.

When paired with a platform like Sonar—and integrations from Adtran, VETRO, and CrowdFiber—you’re equipped to build smarter, scale faster, and stay compliant from day one.

Explore new broadband funding opportunities with Adtran’s Portal

Discover how Sonar Software powers expansion with automation and precision.

Q1. What’s the fastest alternative to BEAD funding?

State USFs often move within 3–6 months—faster than most federal programs.

Q2. How competitive is USDA ReConnect?

Highly competitive. Strong mapping and demand documentation are key.

Q3. How do local partnerships work?

They combine municipal funding with ISP expertise—over $10B in ARPA dollars were allocated this way in 2022.

Q4. What role does private capital play?

Private broadband funding tops $90B yearly and often closes faster than public options.

Q5. How does Sonar help meet funding requirements?

Sonar integrates provisioning, mapping, and demand tools to streamline grant compliance and boost operational efficiency.

The broadband landscape is in flux, creating both hurdles and a wide range of opportunities for internet service providers (ISPs). Rural...

In a move that dramatically shifts the broadband funding landscape, the National Telecommunications and Information Administration (NTIA) has...

For years, fixed wireless and satellite broadband providers have faced an uphill battle in federal funding programs—frequently sidelined by...