3 min read

Why Automated Billing is Essential for Expanding your Business

It’s undeniable that cash flow is the backbone of any business, and that includes Internet Service Providers. Whether you are delivering...

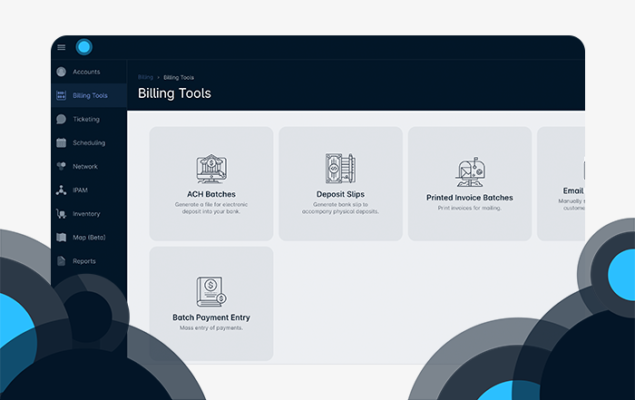

Building a business relies on more than a product and a can-do attitude. Establishing a finance team that can be proactive with the health of your organization and your accounting systems provide a competitive advantage you can leverage. This means equipping your team with the tools they need to succeed, giving them the ability to evaluate costs, savings, and opportunities to reinvest.

Sonar’s reporting module is designed to allow your organization to review and generate custom reports that will assist your teams in reviewing your organization’s information and in tracking essential KPIs.

By incorporating Business Intelligence into your workflow, you’re able to automate the collection of this data, giving your accounting teams more time to analyze the information and provide insights to the organization.

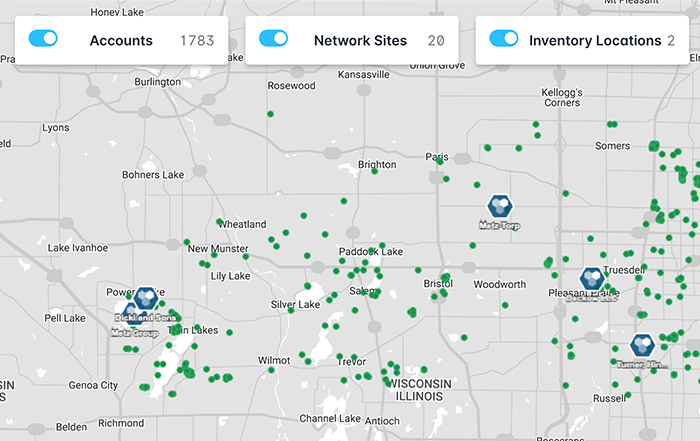

Analyzing data isn’t easy, especially if it’s gathered inaccurately. Many Internet Service Providers are still siloing data, resulting in mislabeled, poorly collated, or poorly interpreted data. A Business Intelligence dashboard allows you to visualize your data and reduce data duplication while minimizing avenues for error.

A good accounting team can succeed with incomplete data, but when they’re given the tools to create customized reports and expand data collection, they thrive. Incorporating BI reporting into your day-to-day accounting operations can quickly improve accounting processes in both obvious and subtle ways:

BI reporting isn’t just about analyzing past spending, either. Providing a BI system to your organization empowers your accounting team to action their hunches when it comes to operational changes or assets. Furthermore, keeping a close eye on your business’ finances can help reduce, if not eliminate, many cases of financial risk and fraud, as more monitoring reduces the opportunities for bad actors to exploit your business.

When comparing reports from different sources, it can be challenging to evaluate objectively. If your finances are being reported on an ad-hoc basis, it’s easy to see the advantages of BI, but if your accounting team is regularly running highly customized reports, it’s less obvious. In these situations, the sunk-cost fallacy can often be part of the decision-making process for replacement services. But the advantages for converting to a Business Intelligence system don’t stop at reporting.

From an ease-of-use perspective, most Business Intelligence systems will offer a very approachable user interface, typically listing out all your reports in a structured way. In Sonar, the reports are broken down between Accounts and Financial categories, allowing you to easily assess which report will be most useful at any given time. Having these reports be pre-filtered can accelerate the decision-making process, which in turn can boost profitability by making it easier to take advantage of potential opportunities.

Additionally, combining reports into a BI dashboard allows your finance team to collaborate on reports more effectively. Most BI systems allow customized reports that can then be used by every member of the team. This way, incremental changes that each offer slight improvements to the reports will combine to make a big difference.

Being able to visualize your reports with BI makes it easier to find trends and opportunities, even if the relayed information is the same as what you can find in a standard spreadsheet. It can also help you spot warning signs in your inventory supply, trends in customer lifecycles, and opportunities for future investment.

Because of the importance of BI systems for Internet Service Providers and their Finances, Sonar provides a built-in BI tool, available to all clients by default. Every user in your instance can review the detailed reports offered by the BI system, which can improve collaboration and responsible finances across your organization. With reports, managers can more easily monitor Key Performance Indicators, network architects can plan upgrades and maintenance, warehouse teams can manage inventory, and accounting teams can review trends, transactions, and value.

The default reports give you the chance to analyze a wide-range of information, providing ample sources to verify the integrity of your data and removing opportunities for duplication of effort with manual reporting. However, if you find that the default reports are insufficient, Sonar’s reporting subsystem allows you to create entirely customized reports to suit your needs. This is accomplished through the assignment of report licenses, which let you restrict creation permission to a subset of your users. This restriction facilitates the creation of reports with meaningful or useful data to your ISP, rather than the disorganization commonly seen with reporting systems.

There’s no doubt that reporting is a necessary component of a highly effective accounting team, and providing detailed, visualized reports can extend that effectiveness to the other teams that make up your Internet Service Provider. Incorporating Business Intelligence into your operations can help you save money, grow faster, and scale your business.

3 min read

It’s undeniable that cash flow is the backbone of any business, and that includes Internet Service Providers. Whether you are delivering...

3 min read

Although there is significant debate on how frequently individuals change careers, due to the opacity of what actually constitutes a “career...

3 min read

Starting in 1999, the FCC has required most service providers to provide census block data about their subscribers twice a year in the form of...